Simplifying Income Tax

Self Assessment.

Embrace the digital tax revolution with APARI Pro and benefit from the market disruption for 12 million Self Assessment taxpayers.

Trusted by these key partners

Why APARI Pro?

Improves your margin

Maintain high service level for low-fee clients while reducing cost.

Spreads your workload

Minimise stress and last-minute work close to the filing deadline caused by chasing information.

More time for advice

Free up time to give advice. Reduce admin allowing you to focus on accounting and tax saving advice.

What is APARI Pro?

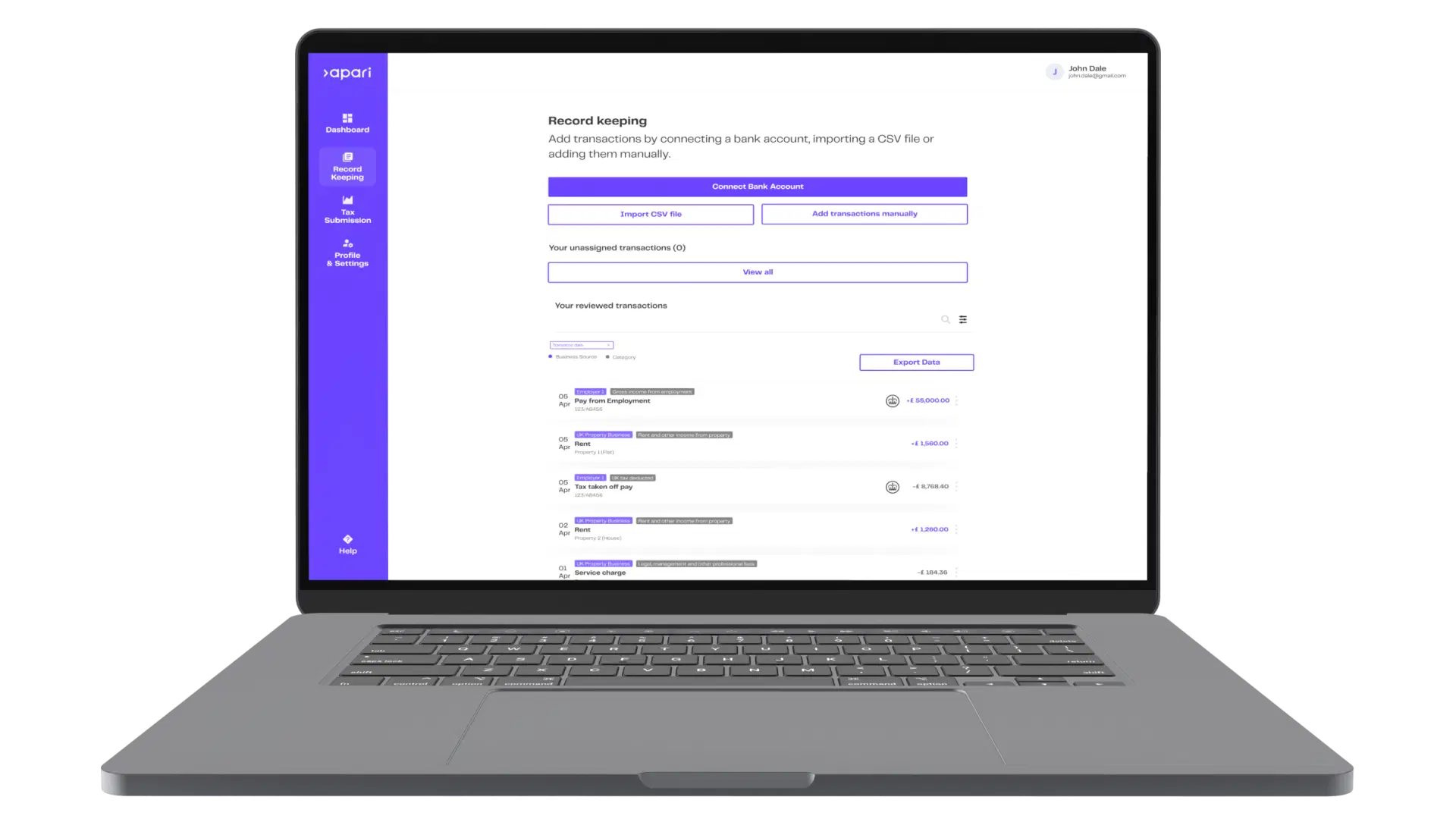

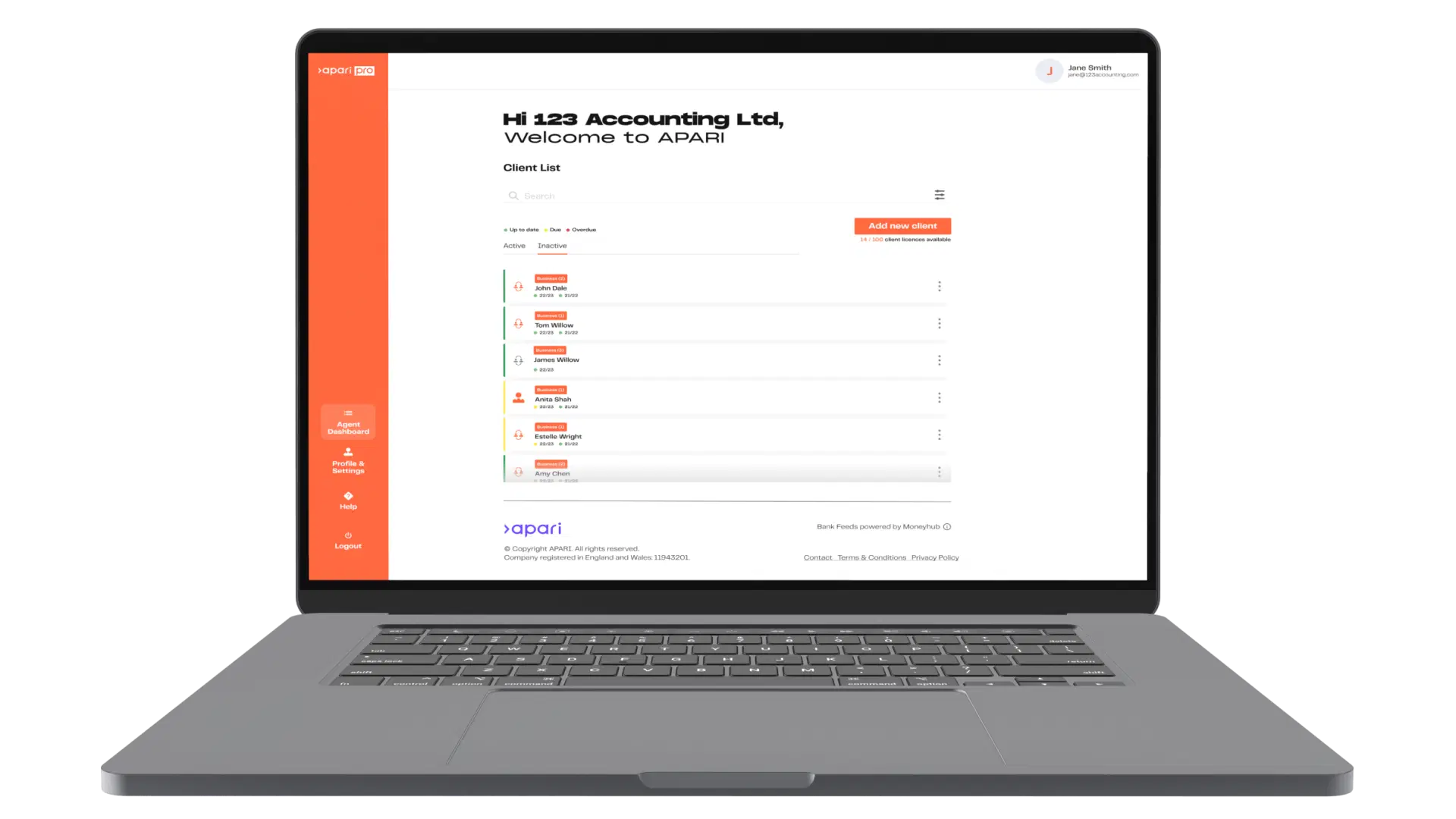

APARI Pro is a digital Self Assessment solution designed to simplify the preparation and submission of a tax return.

We do this by

Accessing a range of data sources to reduce the effort and admin burden of gathering the relevant information for a tax return.

In-built automation to ensure the relevant areas of a tax form are considered and completed.

Direct submission to HMRC from within the platform.

Our solution is designed for

Enterprise partners - where your service creates tax consequences for your clients, such as investments, pension contributions or rental income.

Accountants - with high volume, low-margin clients that are not suited to traditional accounting software.